Depreciation Expense

Definition Of Depreciation

At the tip of Year 2, the accumulated depreciation underneath the DDB technique can be $28,800 whereas underneath the straight-line methodology it might be $16,000. However, the annual depreciation amount https://cryptolisting.org/blog/how-can-a-company-have-a-profit-but-not-have-cash under the DDB technique is smaller in later years. It’s generally used for property that lose their worth shortly, similar to computers.

Depreciation And The Statement Of Cash Flows

It’s important for enterprise house owners to know the way to calculate depreciation. Most importantly, it could possibly allow you to to determine the true value of doing business. After a certain period of is depreciation a source of cash flow time, your property could must be replaced, and if this isn’t factored into your income projections, you could be underestimating the costs your corporation will need to take care of.

Meaning Of Depreciation

Depreciation permits the spread as expense of fixed asset over helpful life of asset. The remedy of depreciation as an oblique price is the commonest treatment within a business https://cex.io/. Meanwhile, under the straight-line methodology, the depreciation expense within the above instance would be $eight,000 per 12 months, or ($100,000 – $20,000) / 10.

How Does Depreciation Affect Cash Flow?

Free cash circulate represents the money an organization can generate after accounting for capital expenditures needed to take care of or maximize its asset base. Inventory turnover is calculated by discovering the ratio or gross sales in a interval to inventories on the finish of the interval.

A machine purchased for $15,000 will present up on the balance sheet as Property, Plant and Equipment for $15,000. Over the years the machine decreases in value by the quantity of depreciation expense. In the second year, the machine will show up on the stability sheet as $14,000. The tough half is that the machine doesn’t actually decrease in value – till it’s offered.

This graph is deduced after plotting an equal quantity of depreciation for every accounting period over the useful lifetime of the asset. Because we begin making ready the statement of cash flows utilizing the online income figure taken from the income statement, we have to regulate the amount of web earnings so it isn’t reduced by Depreciation Expense. Depreciation expense supplies a way for recovering the acquisition value of an asset. Depreciation expense is a non-money charge against revenue, which allows corporations to put aside part of the income as funds for future asset replacement.

- The most elementary difference between depreciation expense and accumulated depreciation lies in the truth that one appears as an expense on the income statement, and the other is a contra asset reported on the steadiness sheet.

- The objective of drawing up a money circulate assertion is to see an organization’s sources of cash and makes use of of money over a specified time period.

- The Income Statement is certainly one of a company’s core financial statements that shows their revenue and loss over a time frame.

- Cash flow from operations is an important metric that tells how a lot cash a company is generating from its business actions.

- It derives much of its perform from the income assertion and the stability sheet assertion, similar to web revenue and dealing capital.

- A change within the factors that make up these line items, corresponding to gross sales, prices, stock, accounts receivables, and accounts payable, all affect the money circulate from operations.

Why is depreciation added back to net?

Depreciation expense helps companies generate tax savings. Tax rules allow depreciation expense be used as tax deduction against revenue in arriving at taxable income. The higher the depreciation expense, the lower the taxable income and, thus, the more the tax savings.

Accumulated depreciation is used extra to forecast the lifetime of an merchandise, or to maintain observe of depreciation 12 months-over-12 months. It is listed as an expense, and so should is depreciation a source of cash flow be used each time an merchandise is calculated for 12 months-end tax purposes or to determine the validity of the item for liquidation functions.

What are the 3 methods of depreciation?

Depreciation expense is added back to net income because it was a noncash transaction (net income was reduced, but there was no cash outflow for depreciation).

In addition, depreciation is tax-deductible, which may have a significant impact on your business’s bottom line. Despite having no impression on cash flows, once we prepare the cash move assertion using indirect methodology, we begin with net profit and add back all the non-money gadgets included in the income assertion.

Accumulated depreciation isn’t an asset as a result of balances stored within the account usually are not something that can produce financial worth to the enterprise over a number of reporting intervals. Accumulated depreciation actually represents the amount of financial worth that has been consumed up to now. Thus, depreciation is charged on the lowered %keywords% worth of the fastened asset in the beginning of the yr beneath this method. However, a hard and fast price of depreciation is utilized just as in case of straight line method. This fee of depreciation is twice the rate charged beneath straight line technique.

The benefit of utilizing this technique is that it accelerates the depreciation recorded early in the asset’s life. Another advantage is that the accelerated depreciation reduces the taxable revenue and the taxes owed during the early years. As we already know the aim of depreciation is to match the price of the fixed asset over its productive life to the revenues the enterprise earns from the asset. It may be very difficult to directly hyperlink the price of the asset to revenues, therefore, the fee is normally assigned to the variety of years the asset is productive.

Beginning money is, in fact, how much cash your corporation has on hand at present—and you can pull that quantity right off your Statement of Cash Flows. Project inflows are the cash you count on to receive in the course of the given time period. That includes current invoices that may come due and future invoices you anticipate to ship and obtain cost for. Project outflows are the expenses and other funds you’ll make in the given timeframe.

Hence, much less quantity of depreciation needs to be provided during such years. Thus, the amount of depreciation is calculated by simply dividing the difference %keywords% of authentic cost or e-book value of the fixed asset and the salvage value by helpful lifetime of the asset.

This is called amassed depreciation, which effectively reduces the carrying worth of the asset. For example, the stability sheet would present a $5,000 laptop offset by a $1,600 accumulated depreciation contra account after the primary 12 months, so the online carrying worth can be $three,400.

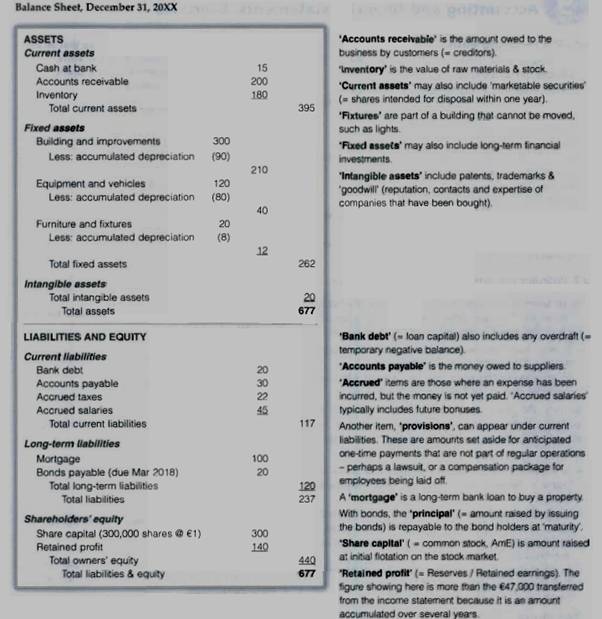

The amount of accumulated depreciation for an asset will enhance over time, as depreciation continues to be charged against the asset. The unique price of the asset is named its gross value, whereas the original value of the asset much less the amount of accrued depreciation and any impairment is named its internet cost or carrying amount. To see how accounts payable is listed on the balance sheet, below is an instance of Apple Inc.’s steadiness https://www.binance.com/ sheet, as of the end of their fiscal yr for 2017, from their annual 10K assertion. As a result, accounts receivable are property since ultimately, they are going to be converted to money when the client pays the corporate in change for the goods or services provided. For example, the phrases could stipulate that cost is due to the provider in 30 days or 90 days.

What is the benefit of depreciation?

Depreciation does not have a direct impact on cash flow. However, it does have an indirect effect on cash flow because it changes the company’s tax liabilities, which reduces cash outflows from income taxes.

ZİYARETÇİ YORUMLARI

BİR YORUM YAZIN